A business needs debt to grow but must be careful not to take on too much debt.

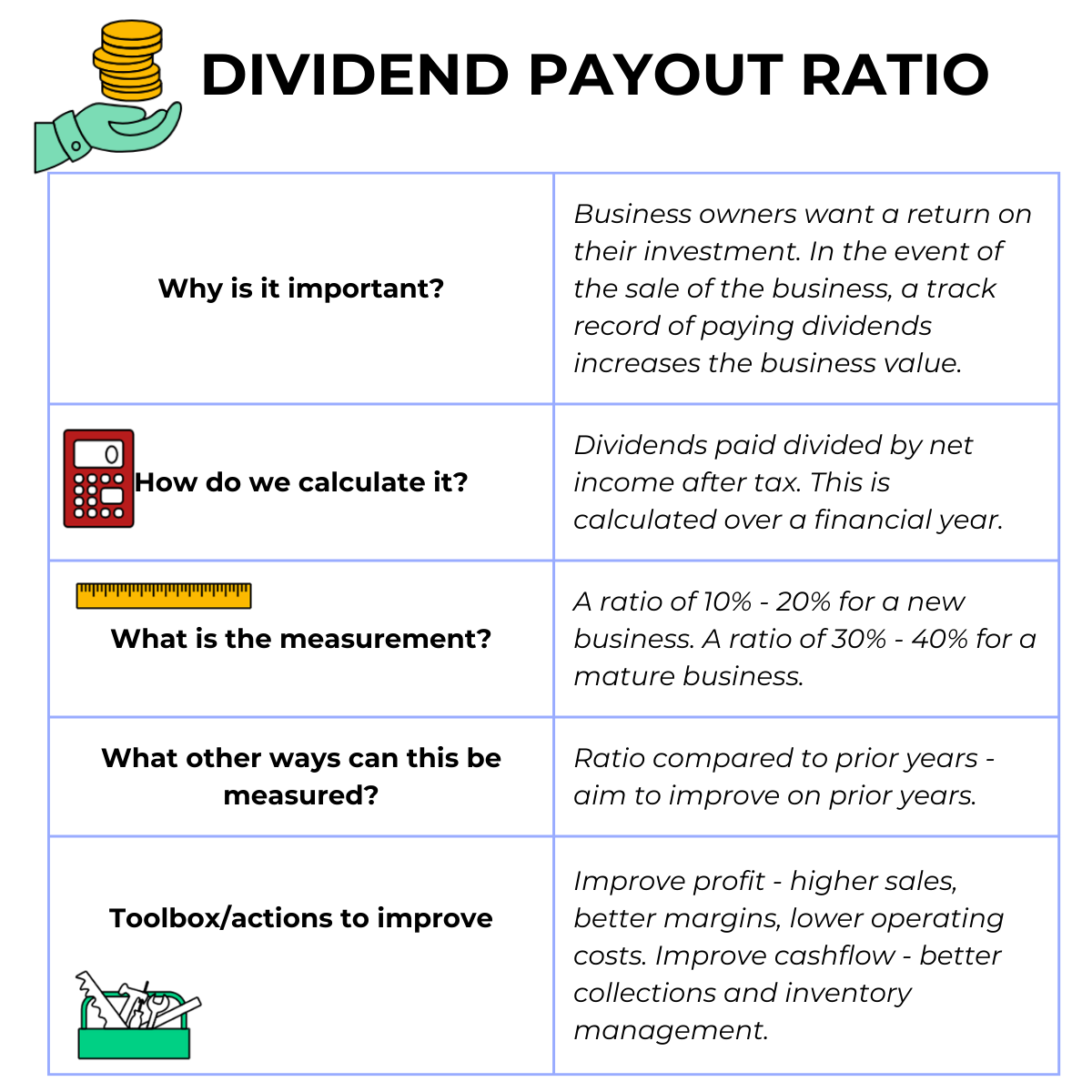

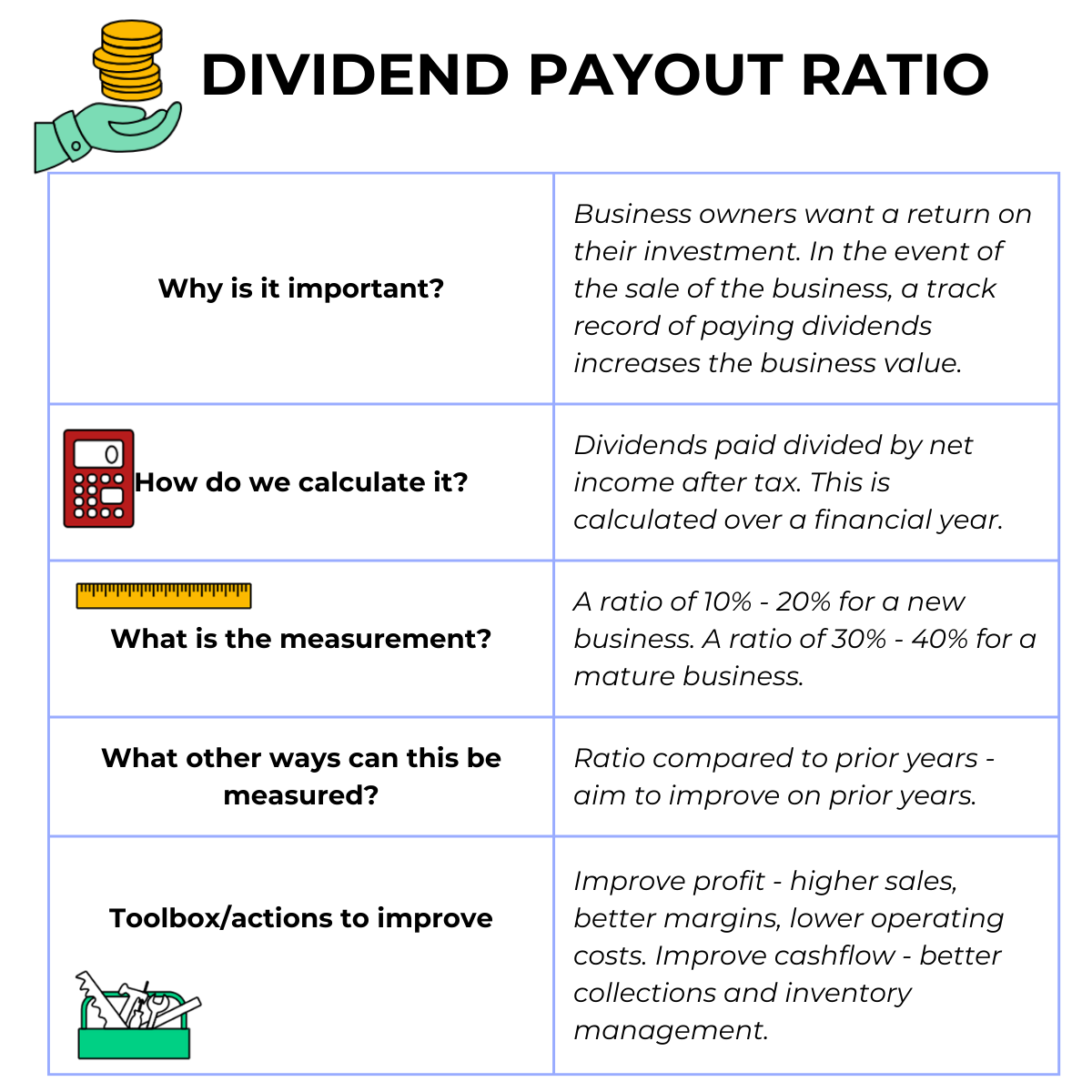

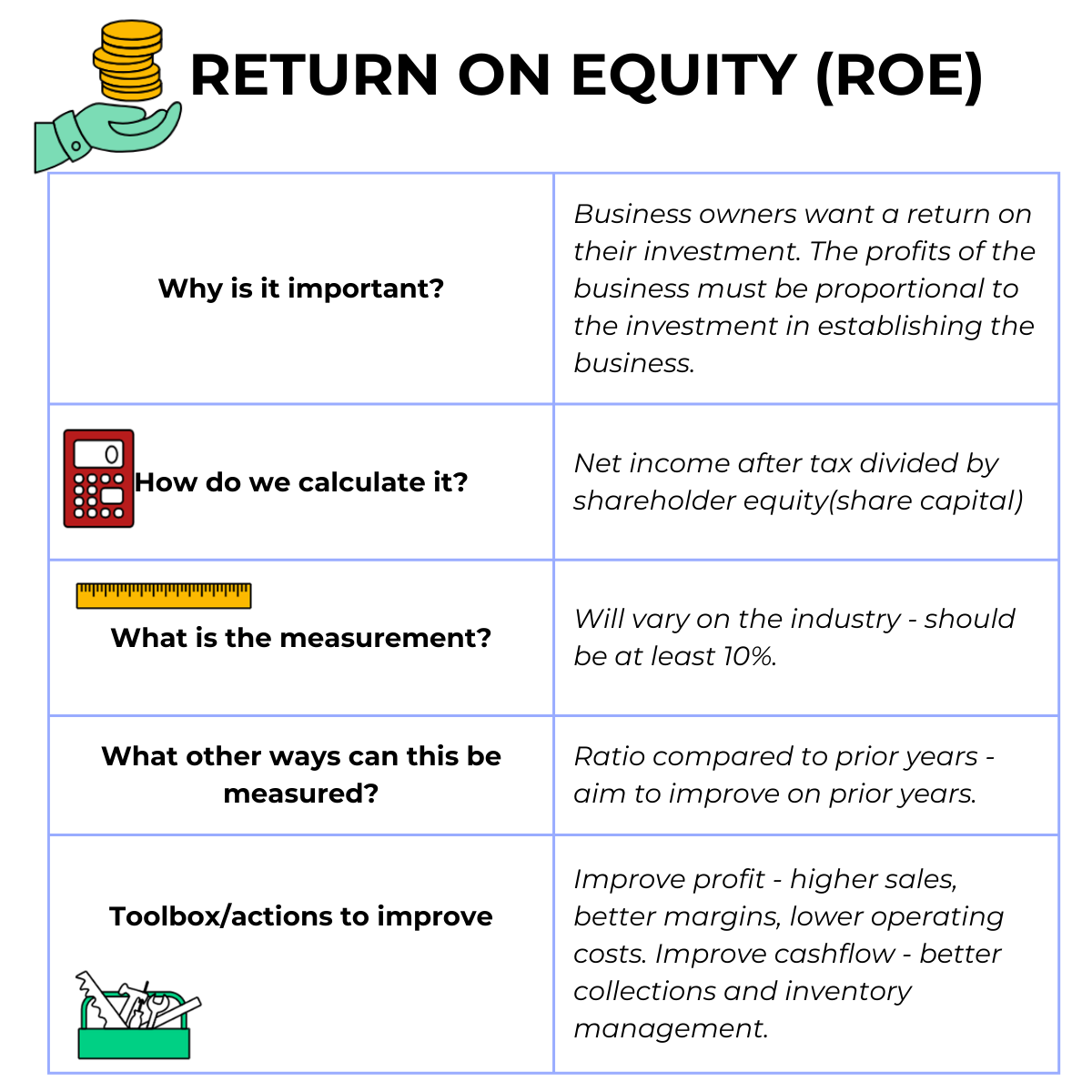

At the same time, owners want to make sure they are getting a return on their investment in the business.

Here are 4 KPIs that cover these areas.

If a company has net profit after tax of $100 000 and pays a dividend of $20 000, the dividend ratio is 20 000 / 100 000 = 20%.

The profits a company makes must be in proportion to the cost of establishing the company.

Example 1

2 friends set up a factory with total investment of $2m - their equity is $2m.

Net income is $200 000. ROE = 200 000/ 2 000 000 = 10%

Example 2

2 friends set up a factory with total investment of $1m - their equity is $1m.

Net income is $200 000. ROE = 200 000/ 1 000 000 = 20%

The profits in Example 1 and Example 2 are the same, but the ROE for Example 2 is much higher.

We have produced the same profit with less investment, so our return is higher.

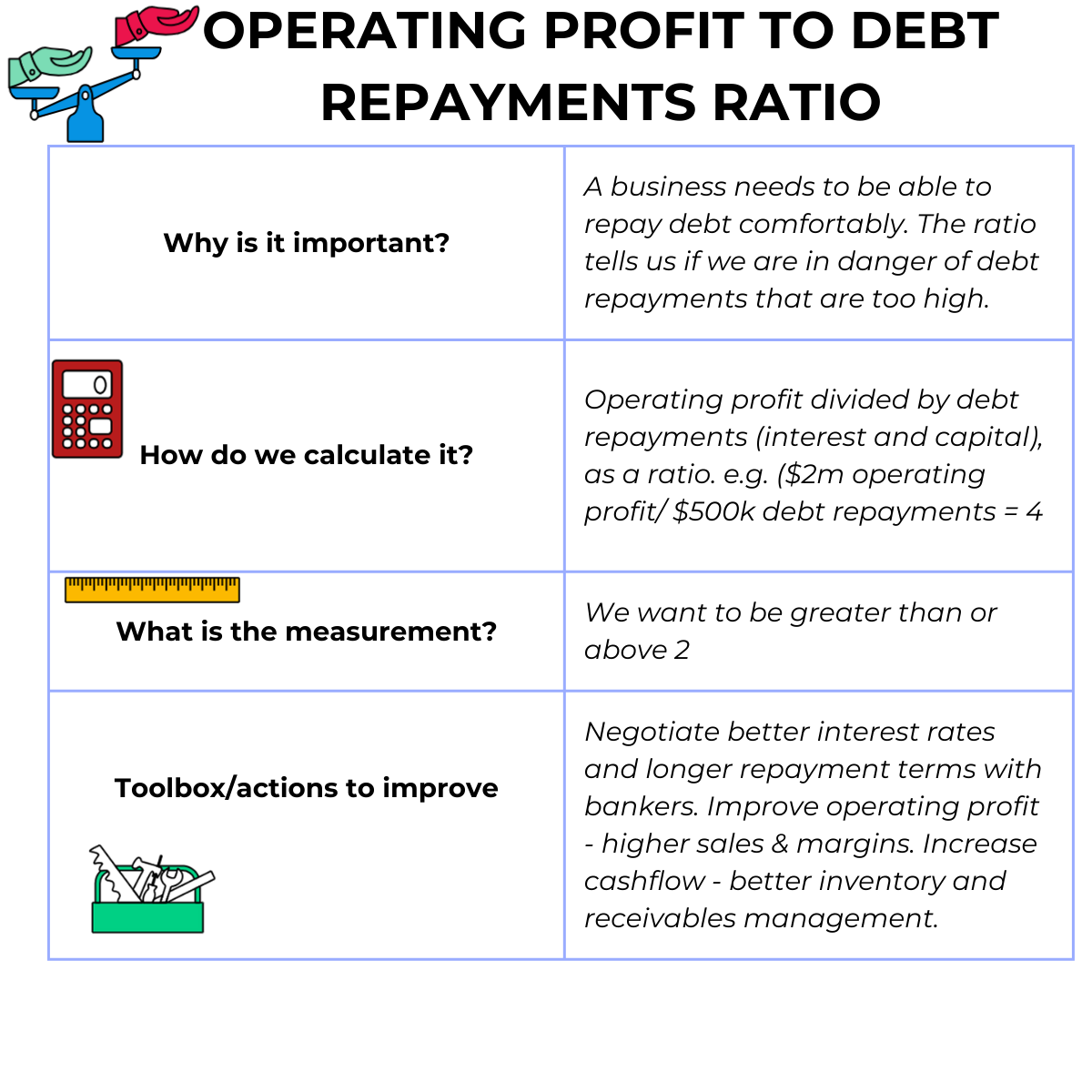

How much debt can you afford?

A simple way to check on this is to compare the operating profit to debt repayments.

In order to repay debt, we need to generate operating profit (sales less cost of goods sold, less operating costs).

Example 1

Debt repayments are $300 000 ($200 000 interest and $100 000 capital).

Operating profit is $300 000

The ratio is 300 000/ 300 000 = 1

We don't have enough leeway here - debt repayments are the same as profit - the debt is too high.

Example 2

Debt repayments are $300 000 ($200 000 interest and $100 000 capital).

Operating profit is $600 000

The ratio is 600 000/ 300 000 = 2

We have enough leeway here - profit is 2x the debt repayments - the debt is acceptable.

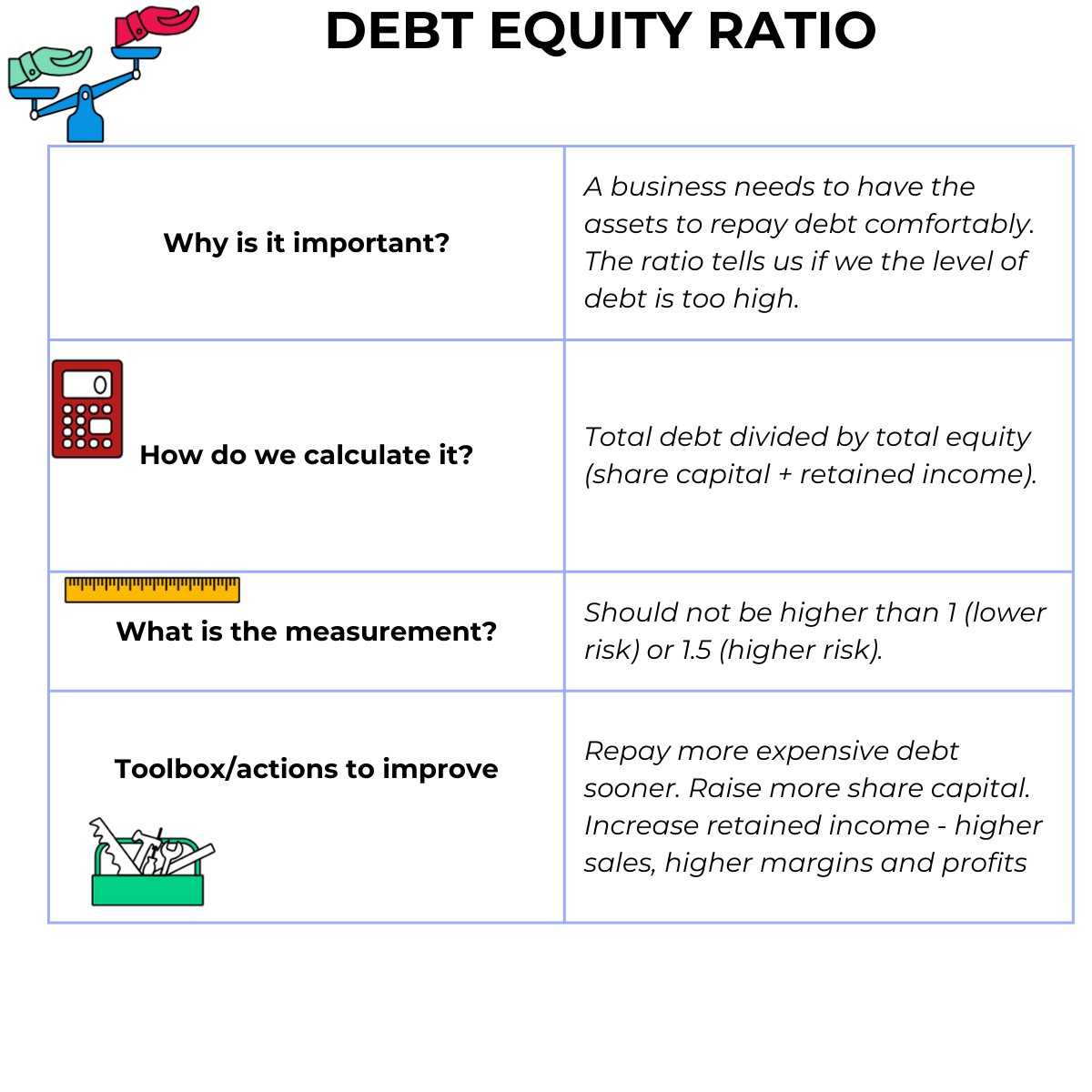

Comparing the debt to the equity of the business is another measure to check if the debt levels are too high.

Example 1

Debt is $2m, Equity (net assets) is $1m

Debt / equity = 2/1 =2.

Debt is too high.

Example 2

Debt is $1m, Equity (net assets) is $1m

Debt / equity = 1/1 =1.

Debt is acceptable.